Speculations are rife in the industry as amusement park giants Cedar Fair and Six Flags explore potential merger.

Cedar Fair and Six Flags: The Amusement Park Giants Dance Again

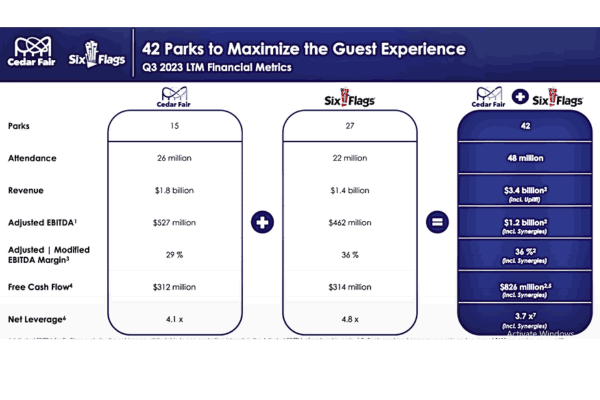

The possibility of forming the largest regional theme park company in the world will be a reality as Cedar Fair Inc. and Six Flags Inc. discuss possible mergers once again against a background of global financial instability and changing customer tastes.

Exploring the Potential: A Mega-Merger Creating the Ultimate Theme Park Experience

Although this is not the first time such talks are taking place, it has got everyone who is connected with amusement parks interested in and anticipating these discussions. Rumors have been circulating for some time, including reports by Reuters and others suggesting that it could come soon in tandem with Cedar Fair’s next earnings report.

From $4 Billion Offers to Synergy Dreams: The Ongoing Saga of Cedar Fair and Six Flags

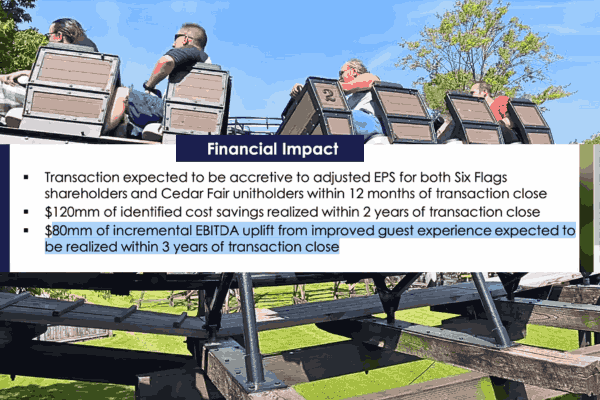

Over the years, there have been many such merger talks, like one example was a $4 billion offer by Six Flags made to Cedar Fair in 2019; however, it now looks as if such stars just might align for a deal to alter the amusement park industry. Although such beneficial synergy may occur at the end of the day, it is not certain whether or not it will be implemented.

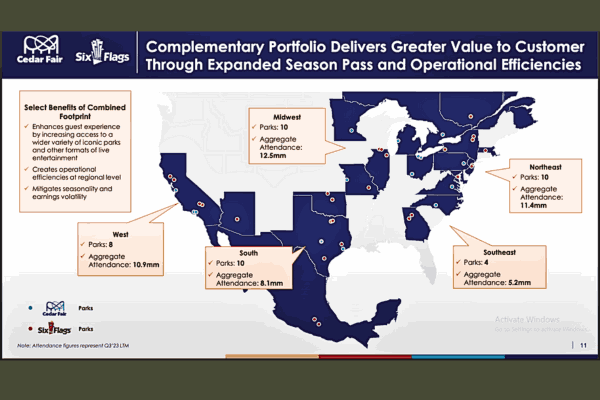

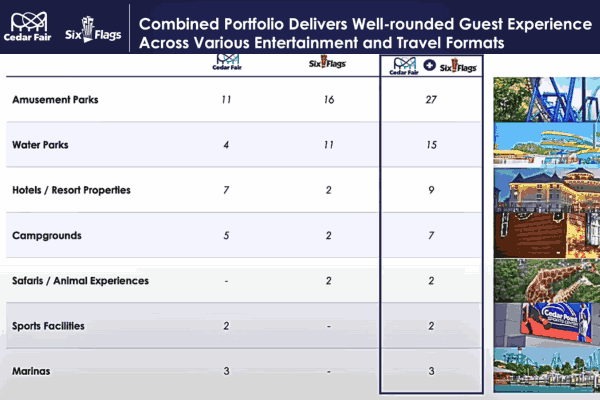

Cedar Fair’s Crown Jewel: Cedar Point, and Six Flags’ Nationwide Dominance

Cedar Fair which is based in Sandusky, Ohio has 11 amusement parks and four water parks located all over America and the neighboring country, Canada. Cedar Point which is their crown jewel and an adored and famous place for the thrills seeker is among them. Additionally, there is a company called Six Flags located in Arlington, TX with 27 different parks all over the US like Six Flags Great America near Chicago and Six Flags Great Adventure in NJ. Such a merger would see this company become one of the strongest industry giants, which would have a huge bargaining strength and access to national sponsorships as well.

Dennis Speigel’s Insight: Merging for ‘Tremendous Buyout Savings’ and Marketing Triumphs

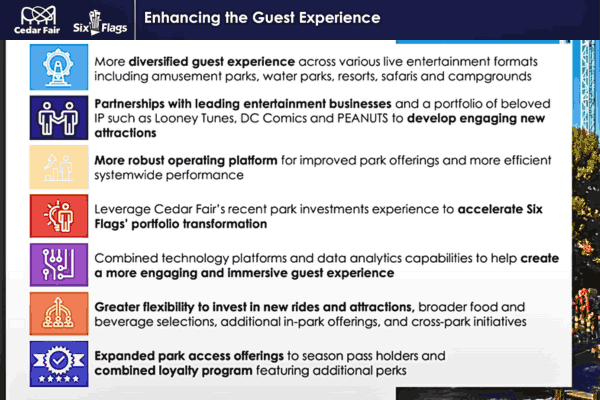

One of the most distinguished industry consultants, Dennis Speigel – President of International Theme Park Services in Cincinnati, believes that merging will present “tremendous buyout savings” creating new marketing chances for collaborations (Croston). This may lead to improvement in the product for the buyers as well as improved guest experience.

Navigating Challenges: How a Cedar Fair and Six Flags Merger Addresses Industry Woes

In the recent past, the amusement park industry has had its own fair share of problems. Due to the COVID pandemic, parks are being compelled to make modifications and enact safety guidelines for visitors’ security’s sake, but economic instability and altered customer choices have been hurting stock performances of these businesses. The acquisition would enable Cedar Fair and Six Flags to combine resources and merge competencies, addressing such challenges in a better capacity and increasing the pleasure derived by the guest.

The buzz on this announcement of the merger as well as its prospects have already started hitting the firm’s Stocks. Immediately after the news, Cedar Fair and Six Flags Shares rose over 6% and 7% respectively.

Stocks Soar: Cedar Fair and Six Flags Shares Rise Amidst Merger Buzz

The thrill and expectation in the air as the industry insiders wait for an official publication can be felt throughout the environment. Although there is speculation as to whether the deal will materialize, it’s enticing to those who relish excitement in amusing places. The precursor of what might be referred to as a blockbuster announcement may be made by Cedar Fair as it prepares to record its third-quarter results. This merger could be another phase in the constant war between Cedar Fair and Six Flags, as the entertainment industry will continue attracting fun-loving people of any age.