On a day like Thu, some of the growthy sectors like Technology, Communication Services had a decent update by really accelerating to the upside. On the Major Indexes, we saw the Dow Jones, the S&P and the NASDAQ, all finsihing in the green. The S&P tested 4200. It didn’t quite close above that level, but it got very very close to this level.

Market Recap – Dow Jones S&P NASDAQ Mid Caps and Small Caps

Looking at a preview of the market action on the last couple of days, we had seen a pretty move, a sort of a follow-through and again this was led by some of the best performing stocks and groups here to date, from areas like Semiconductors, like Computer Hardware and others that were doing very very well and this is what was pushing these risk assets to the upside.

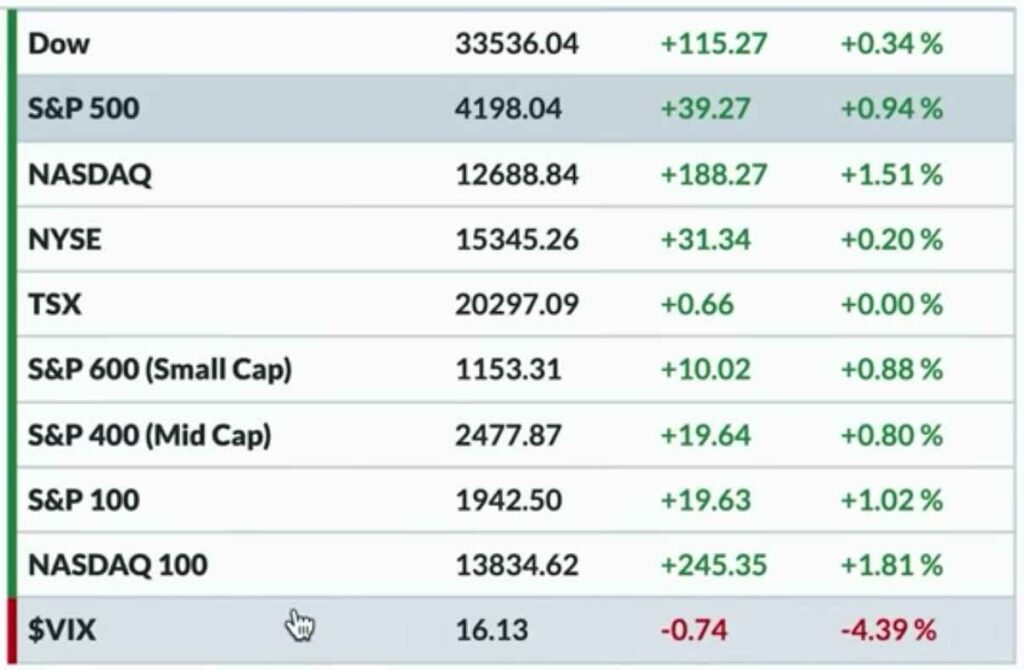

On Thu, the NASDAQ Composite leading the way higher up 1.5 percent. NASDAQ 100 was actually up a little bit more than 1.8 percent.

The Dow Jones was most of the day actually in the red and we had that sort of very familiar pattern of the NASDAQ in the green, the Dow and the red, and the S&P in the middle but, everything got dragged up by the Close. The Dow actually still finished up about 0.30 percent, the S&P finished about 0.9 percent higher and again closed right at 4198 and that was a hair’s breath away from that 4200 level that we have aimed at. The S&P did touch 4200 level, then it traded just above it briefly, and closed right below It.

Mid Caps and Small Caps were both up as well and were about the same, with no real differentiation between large to Mid to small by the the time all was said and done in the markets at close.

The Volatility Vs Major Indexes Dow Jones S&P NASDAQ

The VIX continued to push back low and back lower. This was one of the lower levels in the VIX that we’ve seen year-to-date, down almost to 16. This low has come on Thu, after VIX had pushed up towards 20, in the past, but not too long ago from Thu.

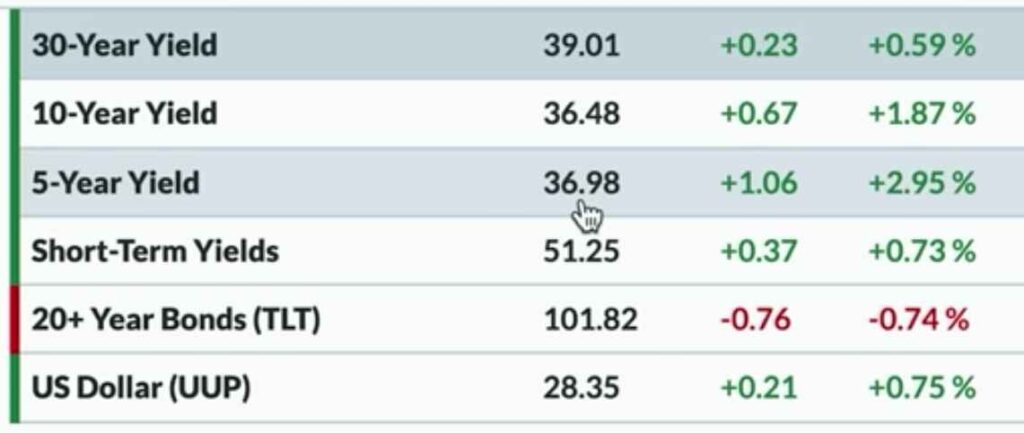

Bonds

As we look at some other asset classes, we see that the Futures Market is pricing in a higher and higher. This raises the likelihood that the Federal is actually not done raising rates and that we might get one more rate hike probably. We will have to wait and see what the future holds, but we know that currently the probability of a higher move is starting to increase a little bit.

10-year, 5-year, 30-year short-term points all moved up, therefore the entire yield curve sort of drifted to the upside. 5-year yields were around 3.7 percent, 10-year yields were around 365.

The dollar Index moved higher on Thu as well. Looking at this one may infer that, strong dollar means weaker stocks and weaker stock means stronger gold. Whatever relationships we may want to come up with however, these seem to be very fluid inter-market relationships and therefore in general, the stronger dollar has been rougher for weaker risk assets. However, in the case of Thu, we saw that the Major Equity Averages moved higher along with the dollar that was moving higher aswell, and the bond prices of course went lower.

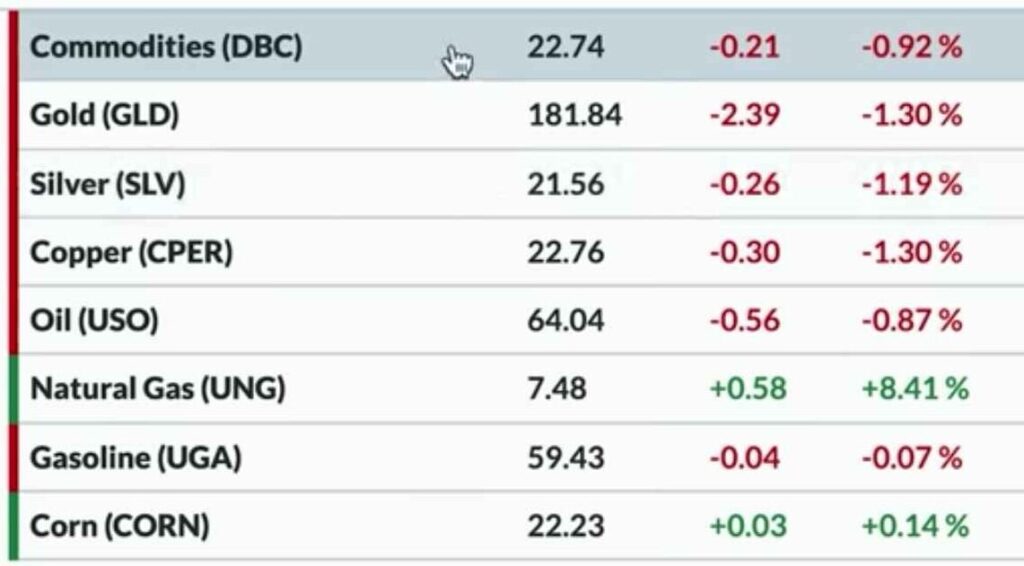

Commodity

Commodities were mostly in the red. Although we had a couple of them in the green but, overall the broader Commodity ETF, the DBC was down about 0.9 percent.

Gold prices continued to push to the downside with the GLD down another 1.3 percent, Silver 1.2 and Copper 1.3 percent as well.

About Gold, we can see a trend, wherein Gold has quickly gone from the upper end of a consistent uptrend, to a now more of the lower end of that uptrend. Probably, we are very quickly at the point where we might be in a different regime altogether, in case of Gold.

Cryptocurrency

Cryptocurrency Cryptocurrency is taking a bit of a bath. During the Equity session, we could see that they ripped and then turned back to the upside very very quickly. However, Bitcoin currently down around 26750, Ether was just below 1800.

Take note that, in the recent past, some of these cryptocurrencies had been very very strong and we had Bitcoin once breaking above 30000, Ether above 2000, and then all of a sudden Cryptos have come back and showed some short-term weakness.

Sector Performance – S&P Dow Jones NASDAQ

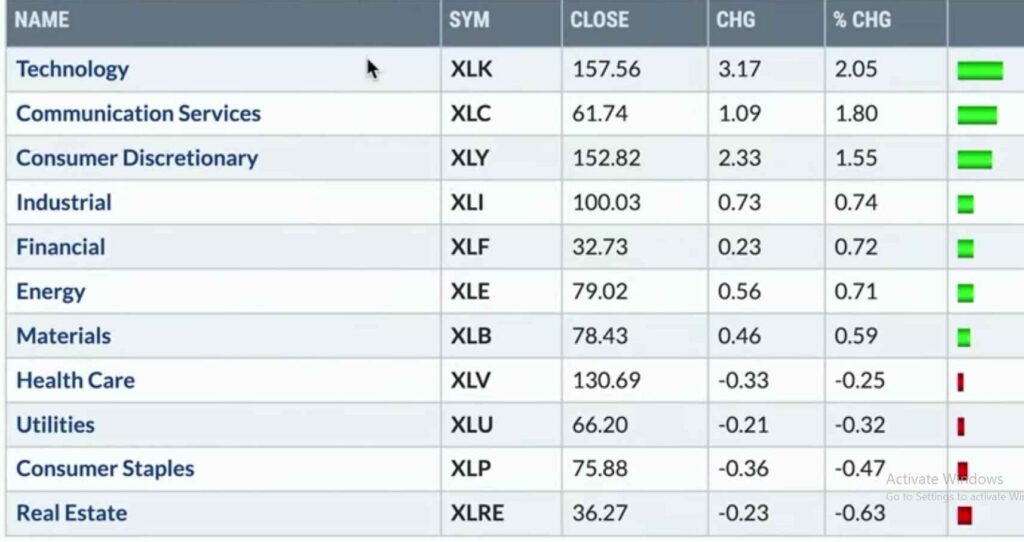

As we continue on with the active trading report for Thu, we may briefly look at sector performance. It was sort of the Fang sectors day, with the growthy stuff at the top of the list On Thu. Technology led the way higher up 2.1 percent, followed by Communication Services that was up 1.8 percent, and Consumer Discretionary was up 1.6 percent.

At the bottom of the list were all the defensive sectors, like Real Estate that was down 0.60 percent, Staples was down 0.5 percent. Some of those stocks of Staples like Procter and Gamble and Coke had looked really good, up until about a week or two ago, but now all of a sudden these have just started to come down. They are pulling back from significant resistance levels and that may be an interesting pattern to watch because that’s an area of the market which had been incredibly strong, relative to other sectors recently and we may start to see a bit more of a rotation, here.

On Thu, Consumer Discretionary outperformed Consumer Staples. Utilities were down 0.30 percent as well.

Stock Watch

Stocks like Home Depot that have been more languishing, but not really have been participating in the uptrend, probably need to now start improving. Home Depot for now has found support around 280. The question is, Can it hold that and not just hold it but, Can it also get itself back, above the 200-day moving average?, Can it make a new swing high and sort of get back to its February highs?. if It does then, we would argue that the market is in a much better position now. However, that’s a big IF.

We next talk about TGT also known as TARGET stock listed on NYSE. We want to buy a stock like TARGET that we can buy or draw a big rectangle pattern. This is what we call a basing pattern and this isn’t going to last forever and at some point TARGET stock is going to get above 180 or below 140 or 138 and whenever that happens that’s the real signal but, for now we’re chopping around right in the middle of a range.