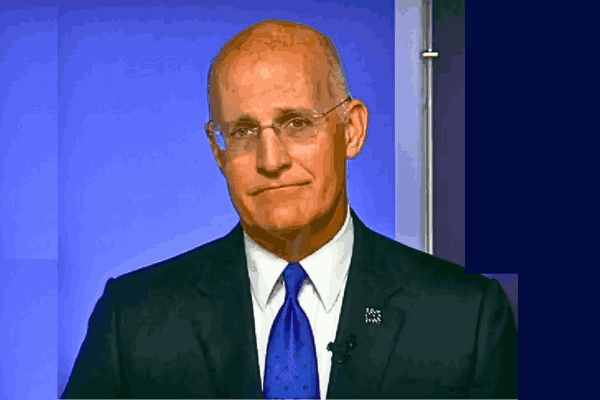

THE LEADER

Andy Sieg, Citi’s new head of wealth, is spearheading a significant transformation within the bank’s wealth division. Since joining Citi last September, Sieg has been strategically reshaping the leadership and driving changes aimed at bolstering the firm’s presence in the competitive wealth management sector.

Andy Sieg’s Strategic Vision

Under Andy Sieg’s guidance, Citi has announced a series of key appointments to strengthen its wealth division. Kris Bitterly will lead Wealth at Work, while Keith Glenfield, a seasoned veteran from Merrill Lynch, will take over as head of investment solutions starting in September. These strategic hires reflect Sieg’s commitment to bringing in top talent to drive growth and enhance the firm’s wealth management capabilities.

Expanding Citi’s Wealth Segment

Sieg’s strategic is focusing on expanding Citi’s traditional banking and lending to bring in a larger portion of clients’ investment portfolios. This effort is crucial for Citi, which aims to capture a significant share of the $5 trillion that its clients currently have invested with competitors. This aggressive shift is intended to position Citi as a formidable player in the global wealth management arena, competing with industry giants like UBS, HSBC, Morgan Stanley, and JPMorgan.

Andy Sieg, Building a Unified Wealth Business

Sieg emphasizes the need for Citi’s wealth division to operate as a unified, global entity rather than a collection of smaller, disconnected businesses. Recent hires, including Dawn Nordberg from Morgan Stanley to lead integrated client engagement, highlight this holistic approach. Sieg’s vision is to build a bridge between Citi’s wealth segment and its banking business, creating a seamless experience for clients and maximizing asset growth.

Addressing Challenges and Driving Growth

Despite the challenges faced by Citi’s wealth business, Sieg remains optimistic about the future. He acknowledges that the division has struggled, with revenue declining and expenses rising. However, he is confident that the changes being implemented will lead to significant improvements. By revamping adviser incentive systems and productivity expectations, Sieg aims to accelerate revenue growth and expand the business’s pre-tax profit margin by 2026.

Andy Sieg, Focusing on Client Relationships

A key component of Sieg’s strategy is deepening Citi’s relationships with its current clients. With $525 billion in investments already under management, Citi sees a substantial opportunity in the $5 trillion that clients have invested elsewhere. Sieg is focused on convincing clients to view Citi not just as a lender, but as a trusted partner in managing their investments.

Looking Ahead: A New Era for Citi’s Wealth Division

The changes spearheaded by Andy Sieg mark the beginning of a new era for Citi’s wealth management business. With a clear vision, strategic appointments, and a focus on capturing a larger share of client assets, Sieg is positioning Citi to compete more effectively in the global wealth management sector. As Citi continues to enhance its wealth division, the bank aims to improve its business mix, drive revenue growth, and solidify its position among the top global banks.

In summary, **Andy Sieg** is leading a transformative effort at Citi, aiming to reshape the wealth division and capture a larger portion of the competitive market. With strategic hires, a focus on client relationships, and a commitment to growth, Sieg is paving the way for a brighter future for Citi’s wealth management business.

Watch here : Podcast on The Growth of Wealth Management

Also Read : Waffle House Employees Who Run the House