THE RESULTS

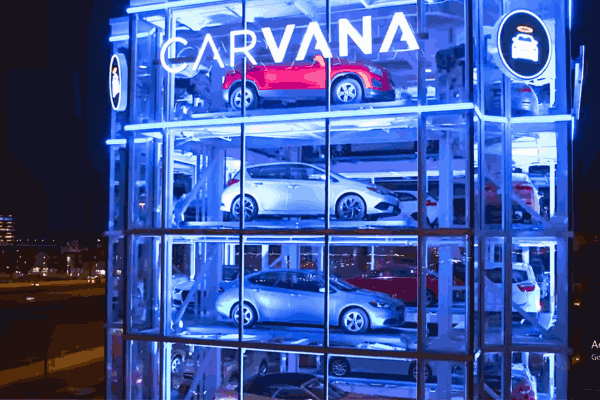

Carvana, the online car marketplace, witnessed a remarkable 30% surge in its stock price after hours, propelled by the release of its first-quarter earnings report. The company surpassed Wall Street’s expectations by reporting revenue of $3.06 billion, surpassing the consensus forecast of $2.67 billion.

This exceptional performance marks a historic milestone for Carvana, with CEO Ernest Garcia III hailing it as the company’s best results to date.

Contrary To Carvana : Ebay and MGM Resorts

In contrast, eBay experienced a 4% decline in its stock price after hours due to its current-quarter revenue guidance falling short of expectations. The company projected revenue between $2.49 billion and $2.54 billion, below analysts’ estimates of $2.56 billion.

Despite eBay’s strong performance in the previous quarter, the subdued guidance overshadowed its achievements.

Conversely, MGM Resorts witnessed a stock price increase after posting first-quarter earnings that exceeded Wall Street’s projections. The company’s success was driven by a substantial revenue boost from its China segment, which surged by nearly 70% year-over-year, contributing to the overall positive sentiment in the market.

Market Analysis and Diversification

According to Edward Jones Senior Investment Strategist Mona Mahajan, 2024 presents an opportunity for investors to diversify their portfolios amidst the Federal Reserve’s maintenance of high-interest rates and the impact of inflation on the economy.

Mahajan advises Investors to leverage periods of volatility to diversify their investments, recommending exposure not only to long-term secular themes like AI but also to various market segments for effective portfolio balancing.

Other Stocks on the Move Like Carvana

Qualcomm experienced a more than 4% increase in its stock price after hours following better-than-expected earnings, while DoorDash observed a decline in its stock price post-market. Etsy, Schrodinger, and Freshworks also encountered fluctuations in their stock prices, with each company reporting earnings that either met or missed analysts’ expectations.

Conclusion

The after-hours market witnessed significant movements in various stocks, with Carvana notably standing out with its impressive surge driven by robust first-quarter earnings. As investors navigate uncertainties such as high-interest rates and inflation, diversification and vigilance in response to market volatility remain crucial strategies for optimizing investment portfolios.

Also Read About Shawn Fain Calls for Union Contract Synching