On a day like Thu, we saw NVIDIA, AMD, semiconductor stocks up significantly. NVIDIA in fact, we do rank it as the top ranked stock in our stock rankings for the large Cap space. Today we will, in particular look at the ripple effects of this move, higher upon Dow Jones and other Indices and other parts of the market and how some other certain sectors did not participate at all on a day like Thu. We will also look into certain areas of Dow Jones and other Major Indexes that are doing very well, while also others that are not doing so well.

Market Recap – Dow Jones S&P NASDAQ Small and Mid Caps

On Thu, It was a big day for some part of the market but, not so much elsewhere, especially because it was a day when NVIDIA was up 20 to 25 percent, which is a of course a big Mega cap name, obviously. In the Technology sector.

It’s interesting that the NASDAQ was up 1.7 percent to just below 12700. The S&P had a decent update as well by being up 0.9 percent to 4151. The Dow Jones managed to remain negative on a day like Thu. Therefore, it was so fascinating to have certain areas of the market doing quite well, whilst other parts not participating at all on this Thu especially when NVIDIA was up 25 percent. The NASDAQ was up almost 2 percent, NASDAQ 100 was up 2.5 percent,

Small Caps actually shed 0.30 percent while going lower. Again this sort of dynamic of The Haves versus The Have-nots, just continues to be reinforced in the market.

VIX

For The VIX, we had already seen a big move higher on Wed, that was just above 20. But on Thu, VIX came down and perhaps this had the market rallying as the volatility lightened up. On Thu, the VIX was down just above 19 and that’s almost a full point below where it was on Wed.

Bond

The interest rates for the most part moved higher. The 30-year long bond yields was just above 4 percent and on Thu, that was pushing again to the upside. 10-year yields Was above 3.8 percent and 5-year point was around 3.9 percent. Short-term yields was still around 5.2 percent.

The dollar actually moved higher and therefore its a sort of a risk-on-feel overall with the major averages. The dollar actually pushed higher about 0.50 percent higher.

Commodity

Commodities, for the most part were in the red on Thu. Gold and Silver continued to move lower. The GLD which is a sort of spot gold was down about 1 percent, Silver was down almost 1.50 percent, besides this copper was in the green and everything else was pretty much in the red.

Energy, for almost this whole week, after actually having lead the way up higher and having outperformed the rest of the markets and the rest of the equity sectors, the Energy sector however had a pretty tough Day on Thu.

Crypto

Bitcoin was around 26500 and that’s up about 0.6 percent since Wed. Ether as well was up about 0.7 percent and that’s just above 1800 to 1812.

Sector Performance – Dow Jones NASDAQ S&P

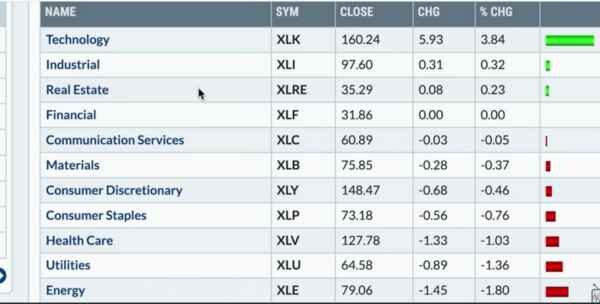

Related to sector movements, it was all about Technology and next was everything else. The Technology sector or the XLK was up almost 4 percent on Thu, and it just continued to push higher.

Again NVIDIA earnings was really the story and alongwith it were only Industrials and Real Estate that were in the green, although not by much. Everything else by the way was basically flat-to-down.

Utilities Healthcare, and Energy were all down by over 1 percent. Energy lead the way lower on Thu, and this was an exception, because for most part of this week until Thu, Energy was up and had been the bright spot, whilst others had been a little more risk off.

Stock Watch Semiconductors

In the current Market environment we see semiconductors leading up to Thursdays show. As it was all about NVIDIA’s earnings, we certainly saw a nice surprise upside, certainly a renewed optimism in an area of the market that has been one of the stronger areas.

Stock Watch SMH

Next we look at the stock of SMH. While observing at this stocks longer term trajectory using its weekly chart, we see a very clear rotation of this stock from strength in 2021, followed by weakness in the first three quarters of 2022 and then a nice reversal to the upside in 2023. The momentum is strong but not excessive, the relative strength is strong as well. We will perhaps have to wait for the market to tell us that the trend is no longer in place but, as we follow the trend, weigh its evidence in the form of Price, we think that, at this point semiconductors are continuing to show strength to the upside.

Next, when we look at new 52-week highs and lows, we see Nvidia is gapping higher. As we start to look at breath data on stocks making new 52-week highs and lows, one of the interesting environments or interesting conditions of the current market is that, in the current environment, not many of the stocks are currently making new 52-week highs, relative to historical raging bull market phases.

The Gold Movement

Finally Gold is struggling and it’s been one of the stronger areas of the market in 2023, up until the beginning of May, but then all of a sudden it started to retrace to the downside. The GDX, the GLD have now broken their 50-day moving average. We are more interested to see that the GDX Gold stocks will now be oversold and I think that might be an interesting one to keep an eye on to see if we get some sort of bottoming pattern as we near a potential Confluence of support. we have the 200-day not too far below.