When we look at Tuesdays markets involving Dow Jones, the S&P and NASDAQ, we find that, investors are as irrational as ever and we have been seeing a lot of these similar movements in the market, through the course of this week. We sort of have this quiet waiting period before some inflation data, jobs data, all of these things come out through the course of the week.

While the Market Major averages pull back a little bit and then a choppy phase continue within this choppy period, a lot of individual stocks are on the Move. We’ve got some earnings this week that are causing stocks in the Energy Sector, some Technology sector and others to have some moves to the upside and the downside as well.

Market Recap – Dow Jones S&P NASDAQ

As we Recap on Tuesdays Market trade it was sort of a choppy period on Tue and the market on Tue really netting out to more of a negative than a positive day and that really happened through the afternoon and further continuing into the close, when things really started to roll over.

Dow Jones S&P NASDAQ

The S&P finished down about 0.5 percent and that’s just below 4120. Therefore S&P still about 4100, which is important but you know stalling out in attempts to get above 4200, the markets continue to pull back off, and further off that significant level of resistance.

While the Dow Jones Industrial Average was down by more than 50 points or 0.74 percent.The NASDAQ Composite lead the way lower down about 0.6 percent. Mid Caps and Small Caps were all in the red as well.

The VIX In Markets Today – Dow Jones S&P NASDAQ

The VIX was the only thing which was in the green and we saw the VIX pushing higher a little bit. VIX was back above 17 around 17.70 and therefore the volatility environment remains low. In a general back of the envelope level for the VIX, a VIX above 20 means we are in a volatile environment.

Based on some of our basic definition of the VIX, this means uncertainty or elevated uncertainty or elevated instability and certainly it means there is potential for a lot of movement.

A low VIX that is below 20 means we are sort of in that choppy unknown phase and sort of settling into a range. This is pretty much how we would describe the current market environment. However, again a day like Tue, ending with sort of that waterfall decline into the close is not really what we would have wanted to see towards the end of the day, especially if we were more on the bullish side.

Bonds

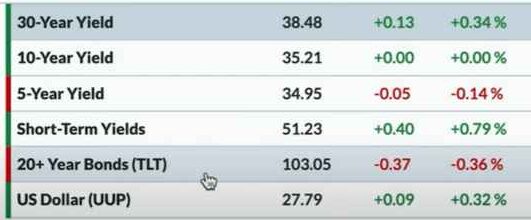

In the current markets interest rates, there was no major changes. The 10–Year yield was pretty stable from where it was on Mon. There was a little movement on the 30-Year and the 5-Year yield, but overall the yield curve remained fairly stable.

Currency

The Dollar was up about 0.30 percent. This we see, was not enough to really cause any effect elsewhere in the markets but you may notice that Dollar certainly was not trending downwards on Tue.

Commodity

Commodities were a bit mixed. Gold was actually in the past positive. Gold finished up on Tue, by 0.7 percent, and it was Interesting to see, that even on a down day we were having gold continue to push to the upside. Spot Gold tested all-time highs above 2000 dollars an Ounce.

Oil prices moved up a little bit as well and the rest of the commodity space sort of was flat to net positive.

Cryptocurrency

Mixed results in Crypto space with Bitcoin again pretty consistent from where it was at Monday’s close. Here again we were sort of in that choppy unknown phase. One may think the market is keeping the powder dry as if it were sort of preparing and bracing for inflation data which happens to be coming through, over the next couple of trading sessions. This inflation data has the potential for significant Market movement and impact, for sure.

On Tue, only two of the S&P sectors actually finished in the green. Industrials only got 0.2 percent and Energy was just a hairs breadth over zero. The one sector that was flat is Consumer Discretionary. Everything else like Healthcare, Technology, Materials was down.

The weakest sector of the day was Materials and it was still down, which was less than 1 percent. So overall this market is still the one, which was a sort of, that choppy sideways.

Promising Stocks

On the new 52-week high stock list, there was Salesforce.com.

As concerned, the Gold ETF GLD, Gold has been one of the stronger places in the market certainly year-to-date. Also, over the last six months if we are hard-pressed to find a better set of Trends which is off of the October low of last year then, we can consider that for Gold. For Gold,

If the long-term trend is still positive then, we may get some short-term pullbacks, just like the one we saw recently in March and early April. This is what we could be watching for, if we continue to rally on the stock of GLD, as it is happening now.

Finally, in the current market scenario, when we consider, Stocks versus Bonds scenario, overall the bet still favors Stocks, as we check this over the last couple of years data but, stalling up now, for the moment, the bonds and stocks are both, sort of evenly placed now.

The second to consider is S&P in terms of Gold Stocks over Rocks. Rocks are outperforming by the fact that this trend is going lower, so we would have been better off owning Gold versus the S&P.

Base Metals versus Precious Metals is also going lower and overall that is not a bullish sign for stocks and suggests some weakness in play.