Image by Peggy und Marco Lachmann-Anke from Pixabay

Monday Market Recap – Dow Jones and Other Major Indices

We started this week off right well and look at what happened on Mon. If we really want to look at the big picture, then we will dig a little bit into the S&P 500 that continued to hit that 4300 level along with the Dow Jones and NASDAQ firing up together aswell. Last week we stalled out at this level and that was what we call the power on stall. Do we now, power through and regain the upside momentum?. Some individual stocks like Cruise Lines, Adobe and others look positive.

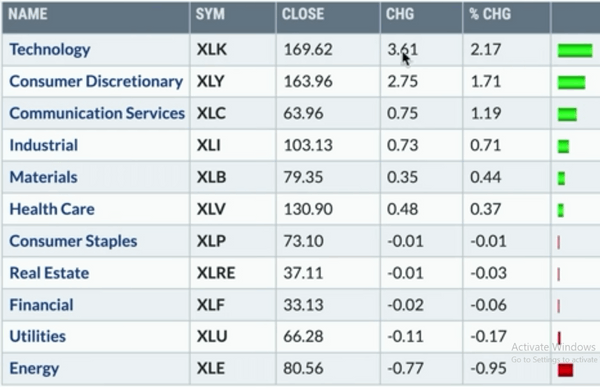

Today we’re going to talk a little bit about the Fang sectors. Communication Services, Technology, Consumer Discretionary at the top of the list today. Yet again, we are seeing further strength on the major benchmarks. 4300 is in the rear view mirror for now. Is there enough upside momentum to keep going this time?, we will have to see what we can see when we break down the stock chart of the S&P and some other charts as well.

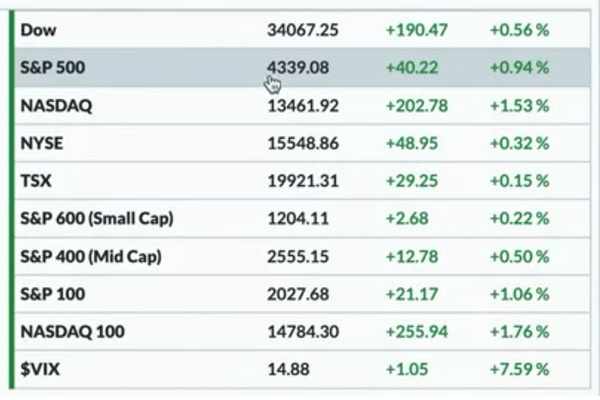

Let’s get to our Market recap and as we Mentioned, it was a nice day for growth Sectors, therefore if you are in a Tech or Communications sector, you may well had a pretty decent day on Mon. Let’s look at the particulars and see how things actually played out. The S&P 500 finished the day around 4339, that’s up almost 1 percent from Friday’s close, the NASDAQ Composite was up even better, about 1.50 percent, the NASDAQ 100 lead the way higher up 1.8 percent.

The Volatility In Dow Jones and Other Markets

Generally, about volatility related to stocks, we are so programmed to think that, higher stocks corresponds to lower volatility and higher volatility corresponds to lower stocks. Over time in general that has happened but, Monday was one of those days, when stocks are rallying and the VIX is actually rallying as well, which is a little unusual. Usually there is a bit more of an inverse relationship but, on Mon, for what it’s worth the VIX is actually getting back up towards 15. This is after going below 14. In the end of last week we had seen the vix making a new low for multiple no. of years, and was down below the lows of 2021. Therefore, if we talk about a low volatility environment, we are sort of very much there but, Monday It was sort of moving back to the upside.

We think that, this is an important trend to watch through this week and also certainly through the FED meeting, We would like to see, what sort of altitude we will assume as there is plenty of volatility around the upcoming FED meeting, due to the uncertainty surrounding what the FED may do next. It is usually a bit of a quiet period leading into a Fed meeting like this, as we have two key metrics to pay attention to this week namely, the CPI number coming in tomorrow and then we have the FED meeting on Tuesday and Wednesdays when we will have the press conference with Jerome Powell, where we’ll have the latest updates and that’s when things can really move. In the period between the FED announcement and the press conference,

Bonds

We all know that, its a crazy period for stocks to be volatile. Therefore, we are likely to pay attention to that however, its perceived to be a quiet period with Mondays close and then Tuesday leading into that upcoming events. This week is going to be a little different because of the CPI number coming out on Tue and that certainly has some Market moving potential for what it’s worth today.

There wasn’t a lot of change in the short end of the Curve. The short end or the 5-year Point was pretty similar to where we were on Friday. Tenure and 30-year points both were up by about 0.2 percent, which takes us to 377 on the 10 year or just around 391 on the long Bond or the 30-year.

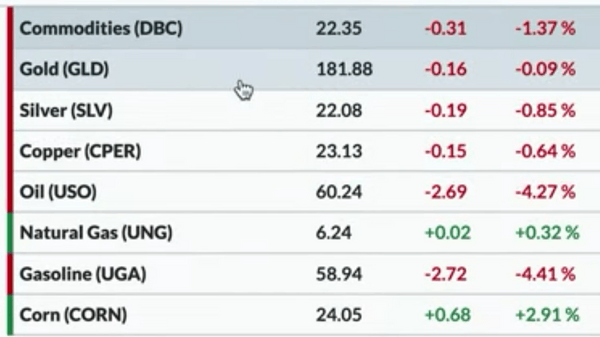

Dollar Index did not change too much from Friday and it was sort of similar. The same can be said for Gold and hence, Dollar and Gold were kind of similar to where we were on Friday.

Commodity

Commodities as a whole moved lower and it involved Crude Oil prices that pushed to the downside The USO was down about 4.3 percent and we could see the other parts of the Commodity complex that was sort of mixed but, Oil had come down quite a bit. Oil has the biggest weight in most Commodity ETFs because they are weighted around with the different types of contracts, accentuated by energy or a higher energy weighting than other parts of the commodity space therefore, when oil prices are Weaker, it usually brings down the DBC as Well. We could see the Energy sector as the worst performer, out of the 11 other sectors on Mon.

Into Cryptocurrencies, Bitcoin continued to push to the downside. Bitcoin currently Is around 25800,. this is down from 30000 that it was during the weekend. Bitcoin was only down about half a percent on Mon, but a lot of that other downward movement happened over the weekend. Ether also moved lower, and was just above 1700.

Sector Performance

In the sector movements, it was the Fang sectors at the top, followed by everything else. Technology lead the way higher, up about 2.2 percent, followed by Consumer Discretionary and then Communication Services. As we look at offense versus defense stock chart, XLY versus XLP and the equal weighted versions of those as well, have clearly been favoring offense or Consumer Discretionary over Staples and on Mon, it was yet another move in that direction, where the Cap weighted and the equal weighted version, were very clearly favoring the offensive side of Consumer Discretionary with a sort of a risk-on feel. Therefore, it’s very much in a risk-on positioning.

Trend and Stock Watch Over Dow Jones S&P and Other Markets

The current trend is where Consumer Discretionary is outperforming consumer Staples and that is more of a risk-on environment. We have certainly seen this in the last six to eight weeks much stronger than we would have really seen, since the beginning of this year.

The relative strength of Semiconductors is an important one to Watch. This tends to be sort of a Bellwether group, a sort of the backbone of the modern economy that we could argue and certainly of the technology that we’re all excited about particularly AI is all about semiconductors and what these companies are doing and the upside potential in these companies and their ability to grow the use of technology. These Stock charts which are going up now, is something that is very impressive a feeling. The other parts of this which are a little less risk-on and which are all about leadership is Small Caps that are still underperforming equal weight S&P, which in turn are still underperforming large Cap weighted S&P.

Looking a stocks with strong relative strength or relative components can be really Valuable. Three stocks namely Cruise Lines Royal Caribbean, Carnival Cruise Lines and Norwegian Cruise Lines, all of these stocks made a new high for 2023. Norwegian Cruise Lines, just did it on Mon and just got above the November high from last year. We are seeing strength in this Cruise space, it really speaks to the strength of the Consumer and the upside potential but these stock charts are saying risk-on.