Earnings are accelerating and we could see volatility increasing. Concerning our anxieties on Bank watch, we could see First Republic San Francisco tumbled another 30 percent.

In Market News for Wednesdays Trading Day of 26th April 2023, it was honestly not a very good day, especially if you were bullish when you entered into trade on Wednesday. After some really good news emerging out of a couple of companies that reported solid earnings, surprisingly though it was disappointing to see that there was a sell off trend prevailing. So, let’s take a look at what happened on Wednesday.

Market News About Major Indices

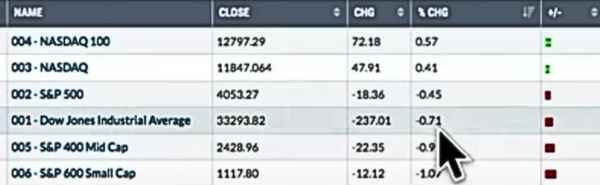

To start off with Market News, the Dow Jones Industrial Average finished down about two-thirds of one percent, the S&P 500 down about four-tenths of one percent, and the NASDAQ did have a bifurcated market with the NASDAQ actually up on Wednesdays trade and was up almost one-half of one percent.

In the early Trading Session Dow Jones displayed good moves mostly because of Microsoft as also the S&P 500 could see a little bit more pronounced action because of Microsoft and this was true with NASDAQ too where one could see even more pronounced actions because of Microsoft.

So it was all Microsoft that was awaiting good performance trade in all the three trading platforms. However, Microsoft was much more heavily weighted in the NASDAQ and it could certainly be seen by the way the NASDAQ performed on Wednesday. Sadly, a lot of those gains from the morning were given up later on during the day.

The action in the afternoon was very disappointing, with the markets somehow bouncing back a little bit as it faded into the close of Trading Day.

Small Caps were down almost one percent, Mid Caps were also down nearly one percent as well.

We could see the VIX climbing and we guess the key level here in the short term atleast, is going to be around 20. The VIX got up close to that level earlier in the session and finished off the highs but since volatility has been on the rise upto the last few days, therefore this is something that needs to be watched continously.

Looking at the days trade performance on all the Major Indices, we can see the NASDAQ 100 in the green but everything else losing ground with Mid Caps and Small Caps lagging behind.

Talking about Sector Performances on all Major Indices, out of the 11 sectors, the one and only one sector, that was up today was Technology, whilst the other 10 Sectors were down, Amongst these 10 sectors that were down, Utilities Sector performance was at the bottom most.

This was a little odd because we could see Utilities and Healthcare, the otherwise two prominent defensive groups were lagging behind on wednesday, completely. Again, this was a little odd because in event of the Dow and the S&P both closing lower, normally we see the more aggressive areas or sectors like Technology finishing down but instead Today we could see the Technology and Consumer Discretion areas actually at the top of the leaderboard.

Therefore we think this was a little bit interesting, but of Course it has to be noted that their Top positions were led by their Earnings report.

There were some big earning news on Wednesday or actually after the Bell on Tuesday. Microsoft had a nice breakout and beat top and bottom line estimates. Concerning Alphabet Google one could see a little bit of a gap up with earnings but then later it came right back down again. It seems Investors would still want to wait and remain cautious right here with Google as they are still waiting to see the breakout or maybe test a major support level before they could be interested in Alphabet Google.

Testing the relative strength on ENPHASE Energy while it ventured into its earnings, ENPHASE Energy could be seen gapping down and clearing the March 17th low. This really proved to be the relative weakness of ENPHASE Energy versus the Renewable Energy Group. ENPHASE Energy was not looking good going into earnings and now one can see why they wouldnt like to hold any stock in the earnings period if it is showing relative weakness.

The one that did have excellent relative strength going into earnings was Chipotle. Over the last three or four months it could be seen that the relative strength of Chipotle was beginning to pick up. Heading into its earnings, Chipotle had blowout numbers and was one of the best stocks on Wednesday.

Next to observe was the Specialized Consumer Services Group Which was Twice Up, was Top in December and in February. On Wednesday, this Group made the breakout and then pulled back and is now getting close to that support level and right on the 20 Day moving average mark. Also Business Training and Employment Agencies group have been very very poor and it can be seen that they are trading near a 52-week low.

TECHNICAL ANALYSIS

The SPYDR wave could be seen pulling down below that 20-day moving average. This has been a concern especially when we’re trending higher so we got to be a little bit careful although, it did accelerate a little bit with the selling. One would like to see the S&P get back up above that 20-day moving average but that was not the case on wednesday and one could not see that recovery.

The QQQ came down and broke below the 20-day moving average as well. One would really want to get back through that 20-day moving average and on an Intraday basis when the QQQ got almost a 315, one could see that it had climbed above the 20 day but then it all came back down later in the afternoon session. It was sad to see the closing for a second day below the 20-day moving average.

Another observation on the QQQ chart that was tracked about a week ago, pointed out that the highs attained last week were all starting to come down and it was option expiration week. Until last week, we had had a big move up there and there were a lot of net in the money Call Premium not only on the QQQ and the SPYDR but in many Individual Stocks.

This therefore always makes us a little nervous going into Options Expiration and One can see that the downward trend is carried over right into this week and we continue to Trend down. So the first thing we must want to see is, number one get back up above that 20-day moving average which is at 314, because if we can do that and if we can stay there then we will be breaking this short term downtrend line.