In our Market Recap report for Thu, we are going to to talk about a lot of those stock names which are on the move. We still see a familiar pattern with the NASDAQ up, the Dow Jones down and the S&P right there in the middle.

When we look at the Major Market averages, it was a sort of that familiar pattern with the Dow lower, the NASDAQ higher, the S&P was right there in the middle. As we actually settled down a bit going into the close, the NASDAQ Composite was around 12 330, and just below it was the S&P which was around 4130. In summary, this is not too much of a change from Wednesdays close.

The Dow Jones And Mid Cap Small Cap And VIX

The Dow continued to pull back. Mid Caps and Small Caps both underperformed on Thu. Both were down about .66 percent, and the VIX did not change much from Wednesday’s close. VIX was just below 17 and holding steady from where it was last on Wednesday.

Bonds

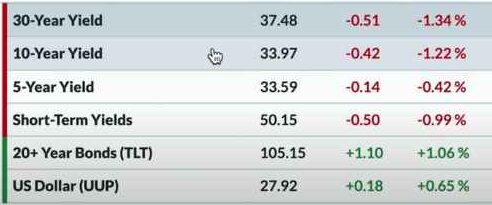

Looking at some of the other asset classes, we find that the overall yield curve continued to push down. 10-year yield was just below 3.4 percent, Long bond yield was around 3.75, and the short bond yield around five percent. What this tells us is basically two things, number one the entire yield curve is coming down because bond prices are going higher. The TLT was up another 1 percent on Thu

Currency

The dollar moved a little bit higher today, with the UUP up about 0.60 percent.

Commodity

It was all red in the Commodities market. We had the DBC which is a broad commodity ETF, was down about 1.7 percent.

Gold and Silver were down as well. Silver was one of the worst performing ETFs here, which was overall down almost 5 percent on Thu. Gold was not quite as negative but we all know that Gold and Silver certainly have been some of the strongest areas of the market year to day. Therefore, we would have been hard-pressed to find better long-term trends in Gold and Silver than some of those other stocks like Meta and others but, Gold has certainly been an area of strength.

Precious metals, base Metals likewise everything in metals was kind of retracing to the downside therefore, overall all the commodity space was down.

CryptoCurrency

Cryptocurrencies were all in the red as well. Bitcoin was down about 3 percent and the same could be said about Ether. Bitcoin was below 27000, that is around 26800 and Ether was down around 1780.

Sector Analysis

Energy was having a tough day on Thu, and it was the worst performing sector, out of the 11 S&P sectors.

We notice a Growth like indicator at the top. With Communication Services up 1 percent, Consumer Discretionary was number two, and was up about 0.50 percent. Staples had a decent day and was up 0.3 percent and even outperformed some of our set benchmarks.

On the downside Energy, Utilities, Real Estate, and Materials were down about 1 percent to 1.2 percent overall. So again, it was not a huge volatility environment because we did not see sectors being up and down 2 or 3 or 4 or anything like that. It is more sort of a quiet period as we would continue to get those Inflation data this week.

On the other side, with all the noise from stocks like Disney that was down 9 percent, Google up 4 percent, Charles River Laboratories up 5 percent, at the end of the day, the major averages are sort of unchanged. We can say this is a sort of the definition of a choppy sloppy environment which is sort of where we would describe investors as Continuing into with.

Stock Watch

Stock like, Builders First Source or BLDR currently looks promising. This stock gapped higher earlier this month, to just above 100 a share and is continuing to push higher. What is interesting now is that BLDR has been extremely overbought, which means an RSI above 80. The last time that happened was in early February, which was after another exponential rise. BLDR later stalled out for a little bit however, the uptrend has Continued. One would be curious to see if we will be having a similar pattern right about now for BLDR.

Finally, as we’re in the earnings season, we’re still sort of wrapping up and we are still having names like Disney and some media names and others sort of still reporting, yet.

Disney gapped lower on Thu, down about 8 percent. The weekly analysis of Disney stock tells a really interesting story. IN Disney, we saw a bullish momentum Divergence, with lower lows through the second half of 2022 and higher lows in the momentum but, overall there is not enough of a follow through to the upside.

Thursdays Gap was a sort of continuing this bottoming pattern and we are not seeing enough yet for Disney to have a true bullish Recovery. The stock is still stalling out and struggling to find its footing.