The Markets on Mon, continued its attempt to push higher. Earlier in the day, the S&P got above 4200, later only to close back below this level. What this mean is that our major indexes like Dow Jones, NASDAQ and S&P, all are trying to accelerate to the upside but failing.

Mon, was a really fascinating Market environment where a small number of stocks were doing incredibly well and continued to press those moves to the upside. Yet again, the NASDAQ Composite had a decent day, going higher and making a new high for the year. However the average S&P stock did not have a decent year or we may say that, necessarily and certainly S&P is not having a great year.

We say this because only a small number of stocks in the S&P are certainly doing well. This means that there is only a narrow leadership and lack of support underneath the hood. Well then, even if the market keeps going higher, it doesn’t matter and whatever we infer from the averages that keep accelerating to the upside however, we still ponder about the sustainability of these movements.

On Mon, Communication Services had another decent update and Staples was struggling. On the Major Averages, the S&P 500 literally ended the day flat. We at some point thought that the S&P would finally get above 4200 and then finally we could make a big noisy announcement about it but, we failed to close above there and we were back below 4200. It felt like this market keeps snatching defeat from the jaws of Victory.

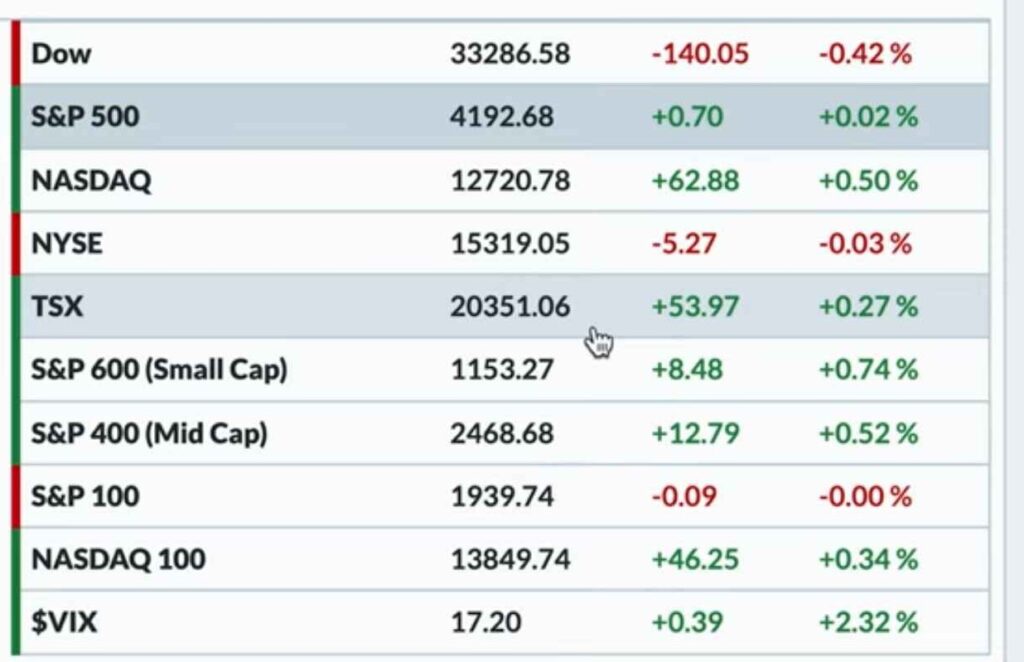

It’s therefore interesting to see how far the market can go, when its driven by only a relatively small number of stocks. NASDAQ Composite had a decent update of 0.50 percent. NASDAQ 100 was up about 0.30 percent, the Dow was down by about the same amount like the NASDAQ was up. The Dow was down about 0.40 percent.

Mid Caps and Small Caps both had a decent day of it, primarily when we have financials doing okay, REITs doing okay, and financials in particular. The Financial sector is the one that is weighed a little more heavily by Mid Cap and Small Caps, and more importantly weighed with all the regional Banks, whilst the S&P 500 is weighed with others of much smaller weight.

Therefore, we say that, on Mon, we saw a nice update for Small Caps, which was up about 0.75 percent. The Mega Cap S&P 100 was flat for the day.

Just like the S&P, the VIX pushed higher as well. As we think about all the different guesses and pieces of information that we can use to validate or invalidate what we’re presently seeing with the major averages and their ongoing attempt to make new highs for the year, we have the breadth and the sentiment at the top of our mind, for sure.

When we look at some of the breadth indicators of the market then, in terms of sentiment, the VIX perhaps is one of the excellent measures of sentiment. VIX is remaining fairly low as it marginally bounced up on Mon, to another 0.4 Point and was up to 17.20.

On Mon, the yield curve overall all moved to the upside. The 5-Year yield was up to around 377, Long bond yields almost to 4 percent. Again, we see continued sort of a push higher in rates, as bond prices are coming down. The TLT was down by 0.30 Percent. We find that the TLT, the AG are getting down to the lower half of their Range, the one that they’ve been in year to date.

Dollar Index did not have much of a change. Therefore, we don’t really have that scenario where, the sort of the dollar strength has killed Risk Assets. That’s happened previously in other Market regimes but, we have not necessarily seen that on Mon.

Gold and Silver both moved lower. Although the rest of the commodity space sort of Was mixed, we had some soft Commodities like Corn with a decent update. Overall It was kind of mixed results for the most part of Commodity. Precious Metals and the Base Metals were all in the red on Mon. Copper prices were down by about 1.2 percent.

Although they didn’t have a great weekend, Cryptocurrencies for the most part, looked pretty positive, . A lot of times we have seen some very significant moves in crypto however, on Mon this was not the case with Bitcoin or Ethereum. It was sort of a noisy period but, there were no dramatic moves. Bitcoin currently was just below 27000 and Ether was hanging on just above 1800, as both of these were up about 0.50 percent from Sunday’s end of day trade.

In terms of sector movements, Communication Services was number one ,that was up 0.90 percent. One of the Top ranked stock with the Top stock rankings and within the large cap rankings is Meta. This one is certainly one of the biggest stock, the top five stock in the US and the strength in the Metas of the world are certainly pushing the XLC to an impressive 0.9 percent upside, on Mon.

On Mon, Real Estate was number two followed by Financials, everything else were kind of flat-to-down. The worst performing sectors today was Consumer Staples that was down 1.5 percent.The XLP hit resistance, as Coke, Pepsi, Procter and Gamble and such kind of stocks, all kind of rolled over after attempting to make a new high for the year.

A Diplomatic Victory After enduring over three years in a Russian prison, American schoolteacher Marc…

THE GRIM SITUATION A heartbreaking Wisconsin school shooting has shaken the close-knit community of Madison…

CHRISTMAS AT MIDTOWN The holiday season just got a little brighter with the highly anticipated…

THE OVERTIME BATTLE In a historic clash, the Georgia Vs Georgia Tech rivalry delivered one…

THE COMPETITIVE THRILLER The highly anticipated matchup between the Giants vs Cowboys delivered a thrilling…

THE WINNING STREAK CONTINUES The highly anticipated Eagles vs Rams matchup on Sunday night at…