Recession Fear looms large as Dow Jones Industrial traded with a major fall of 1276 points on one single day. At the close of trading hours on Tue 13 Sep, this fall was close to a major 4% slide in one single day.

DOW PROGRESS REPORT OF TUE SEP 13.

The major fall of DOW was also simulated by the S&P. The S&P 500 dropped 4.32% to 3,932.69, and the Nasdaq Composite plummeted 5.16% to end Tue 13 Sep trading index points at 11,633.57.

Right from the beginning of the day’s trading hour, the trading trend was not at all gloomy on the Dow Industrial exchange. The day’s trade began with a low of 32006 points. This was very much down from the previous day’s closing of trade which was 32381. A downfall of 374 points from the start of the trading hours. As the day’s trade progressed the index continued to slide further, showing no signs of retracting. At the days close of trading hours, the Dow finally closed at 31104.97, a massive downfall of 1276 points or 3.94% in a single day.

LOSS OF ALL PREVIOUS GAINS AND NO HOPE OF RECOVERY

Trading last week had shown positive rise as investors last week were confident that inflation had already peaked at its maximum height. This perception last week had led to the belief that there was no further scope for inflation to expand. Therefore, beginning 6th Sep last week, Dow which was at a close of 31145, had recorded positive upward trend until Mon 12 Sep, this week. In this span of 6 days, the Dow had recovered almost 1240 points to close at 32381 on Mon. However, this gain was all washed off with trading hours on Tuesday 13 Sep 2022.

THE CPI REPORT AND ITS FUTURE IMPACT

The CPI or Consumer Price Index report for the month of Aug revealed a higher-than-expected inflation rate. This headline inflation rise was 0.1% month over month, despite falling gas prices. The Core inflation rise was reported to be 0.6% month over month. On a year-over-year comparison, inflation was observed to be 8.3%, which was higher than the 8.1% predicted earlier.

Economists surveyed by Dow Jones had been expecting a decline of 0.1% for overall inflation, with a rise of 0.3% for core inflation.

Informative Useful Links

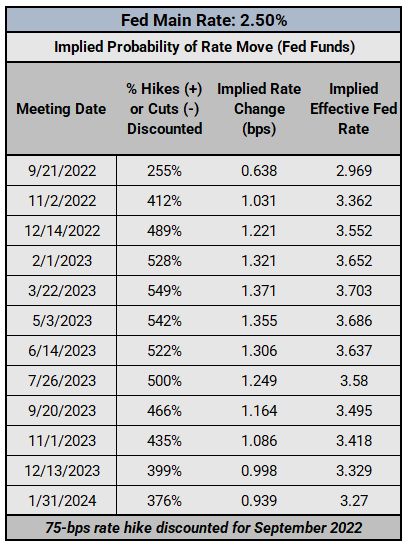

This CPI report will form the basis for the Federal 20th September meeting. In this meeting, the central bank is most likely to announce its third consecutive 0.75-point hike in interest rates. This would be purely a conventional measure adopted to battle inflation. The battle with inflation may press Fed to continue with a series of future rate hikes. This shall add to much distress and agony of investors, who are already tormented with Federal rate hikes announced lately.