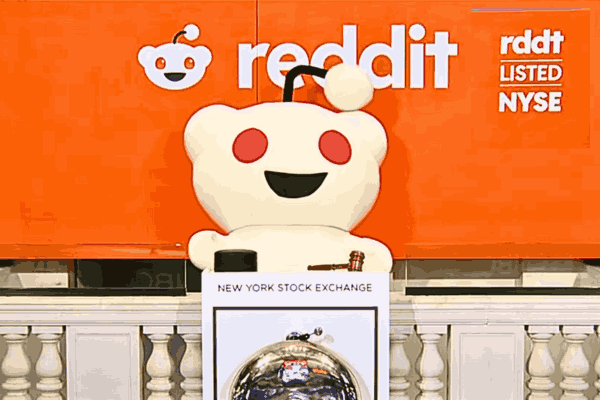

The Much Anticipated IPO of Reddit

The renowned social media platform Reddit, is here on the New York Stock Exchange after the Reddit IPO. Reddit was priced at $34 per share, which now positions the company at $6.4 billion.

Attraction To Reddit IPO

Reddit, co-founded by Steve Huffman and Alexis Ohanian in 2005, is among the best-recognized communities of the Internet comprising of thousands of “subreddits” giving insight into different interests. The platform, with its minimalistic layout due to its resemblance to forum layouts in earlier web phase, has now emerged as a gathering place for millions of people in many countries.

User base is what underlines Reddit’s IPO as one of the crucial factors compelling investors to take notice of it. Reddit, with a daily user count of over 73 million users and 267 million users monthly, is among the most followed social media sites in terms of popularity.

Reddit’s ingenious platform, based on the community principle, has successfully attracted a big number of real users. When scrolling down the website, every user, on average, spends about 30 minutes reading various subreddits.

Main Takeaways from Reddit IPO

- Conde Nast Publications snapped up Reddit a few months after its inception, but six years later, the company spurred a spin-off.

- The platform’s community-oriented and self-moderation nature have developed the solid reputation it holds within its community and among its users.

- Some of the most important features of Reddit are the Ask Me Anything (AMA) occasions, during which users can meet with celebrities and politicians and get their answers to the questions.

Reddit`s IPO has been a matter of debate and curiosity in the financial markets as a lot of investors and analysts are keen to see how the company will enter the arena of public markets. After the IPO, the share price was listed at $34 per share, which gave Reddit a valuation of $6.4 billion. Some insiders think the valuation might even be higher than that.

Reddit’s Financials and Investors’ Interest

- The Reddit publication has not made a profit yet, reporting the losses of $90.8 million last year, and $158.6 million in prior year.

- Still experiencing financial difficulties, Reddit’s IPO ended up being huge, as the investors over-subscribed 4-5 times of the shares offered.

- The IPO featured the sale of stock to the public that amounted to $748 million, of which $228 million were from stockholders who sold part of their stocks.

The Future of Reddit

- Reddit IPO situation may be described as the point at which it starts making money out of its website, without causing discontent among the users.

- Their choice to adopt tighter content moderation regulations in 2020 divided its user base in two, with some pleading they were being watched too closely.

- Through its IPO, Reddit plans to map out a strategy towards eventual profitability along with a loyal-hearted audience that has kept it on the path of energy since the beginning.

Conclusion

The fact that Reddit is one of the pioneer companies going public could be quite an achievement, but the company has to figure out how to overcome monetization and profitability problems. The economical issues that Reddit face notwithstanding, it still enjoys sustains a robust follower base and features a different community oriented approach which has attracted sharp investors who are sure that the platform has growth potential in the future.

Watch here How Reddit’s IPO will Impact the Markets

Also Read About SpaceX’s Successful Starship Launch