On Monday, May 8th, as we talk about the Market environment, we see some earnings coming on but, the S&P NASDAQ and Dow Jones Today were overall looked like they were still yet to recover from last weeks Federal meet.

Market Majors – S&P NASDAQ and Dow Jones Today

In our Market Recap summary when we look at the major averages, we find that they are more or less unchanged. As we look at the S&P 500 and the NASDAQ, we saw that the S&P is essentially flat from yesterday, the NASDAQ was up just a little bit, but not much though. The Dow was down just a bit, so overall it was really a choppy market.

We found that, on Monday, there was no real direction that the market followed and this we could very well see at the end of the closing hours, on Monday. There were a little blips through the course of the day, on Monday, and then in the early afternoon around 2 p.m we saw a drop in the S&P a little bit, but at the end, it was kind of a netting out to a flat Market. Mid caps and Small Caps however moved lower. On Mon, the Small Cap index had underperformed.

The VIX – In the Market Index List Compared with S&P NASDAQ and Dow Jones Today

The VIX is actually moving back lower.We’re in sort of this low volatility environment where the VIX just narrowly last week pushed above but, now it was 17 and down just a little bit from Friday’s close.

Bonds

Looking at some other asset classes we find five year yields were around 3.5 percent, 10 years yield was 3 and Long bond yields around and we could see that interest rates sort of pushed higher through the course of the day on Mon. There was no real change for the dollar Index.

Currency

Dollar Index also displayed a sort of a choppy trade, the one similar to stocks.

Metals

Gold and Silver ended up flat as well. Gold Prices in particular had been stronger earlier in the day but, settled down to finish not too far from Fridays close. Copper Prices went up a bit higher too on Mon. We could see that the DBC, which is a broad commodity ETF finished up about .5 percent.

Energy

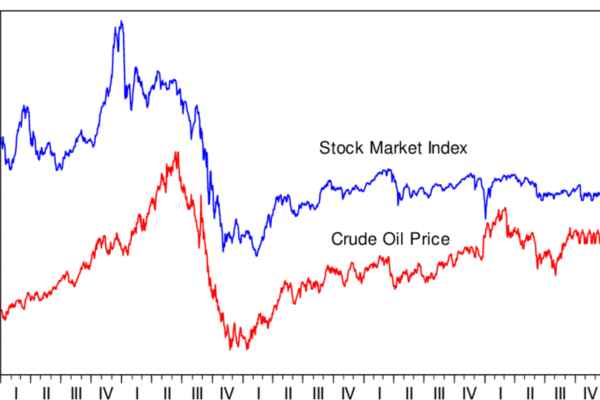

On Mon, we saw Crude Oil prices pushing a little bit higher.

CryptoCurrency

CryptoCurrencies were all in the red because of some talks about regulatory challenges that are being worked upon. Crypto prices were in net on the negative and down about 2 percent. Bitcoin was down about 3.5 percent from Fridays close. Infact, the deterioration in Bitcoin had really happened during the day on Sunday, over the weekend and then it pushed lower through the course of the day, on Mon. Bitcoin, we noticed was around 27500. Investors have long been waiting to see Bitcoin above 30 000. This is the level that Bitcoin did test many times but it we see that it is unable to power up above that level, for now.

The S&P

We saw the S&P at the same level with no real change from Friday’s close. S&P has essentially been choppy sideways and this is right up where we were retesting the highs from February sort of that 4200. We retested it a couple of weeks ago, a week and a half ago and now all of a sudden again once again we’re in this range. On Mon, the S&P traded a little bit below there to the 50-day moving average and if a level like that doesn’t hold then I think we really have to thinking about the potential for further deterioration.

For the major averages for now, we’re still sort of in that holding pattern between two extremes. We will slso be having the inflation data coming out through this week with CPI and PPI numbers. It will be interesting to see the market behavior, then.

Sector Performance – Markets NASDAQ S&P Dow Jones Today

As we look at the sector performances, the Communication Services sector was up about 1 percent, Consumer Discretionary was up about a third of a percent, Financials and Energy as well as Technology were flat for the day and there was no real change. On the downside we saw a couple of sectors underperforming. Particularly Real Estate was down about .60 of a percent, followed by Industrial Materials, Utilities, Consumer Staples all around .30 of a percent lower. Therefore we saw no significant moves and it was a sort of a quieter session.

If we were to talk about stocks wherein we saw some movement on Mon then, it was firstly PayPal and also Netflix. After close of market hours on Mon, Paypal traded up a little bit, about .4 percent higher. This was just below 76. Next, Netflix is a stock that we see going high in February, then lowered high in December, lowered high in March to April but, on Mon, Netflix was bouncing higher a little bit. Stock was up about 2.5 percent. Netflix therefore looked good for today, when compared to its historic trend. .