Image by moneyding from flickr.com

Thursday Market Recap – Dow Jones and Other Major Indices

In our Market Recap, lets focus on how the stock charts have evolved from Wednesdays close to Thursdays close. As we had hinted in our earlier articles, we saw a nice move higher, particularly for the growth areas of the market. We’ve been talking mostly about the concerns in the lack of participation in growth stocks. Really over the last week, we’ve seen some of these leadership names like Alphabet and Microsoft and Apple take a bit of a breather and it opens up the door to all sorts of questions on the sustainability of the trend that we’ve seen year to date.

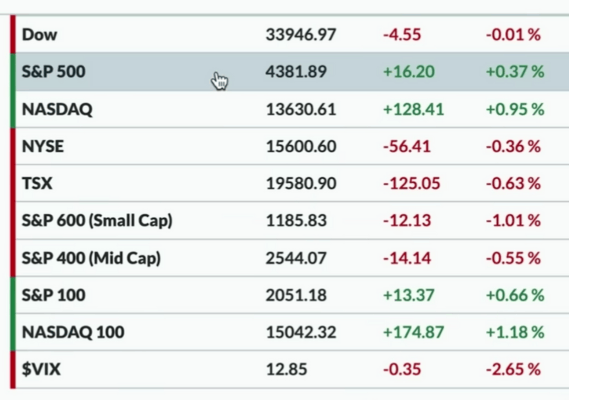

Does that continue, now that we’re in the seasonally weakest month of the year here in June?. June has actually been pretty strong so far but what happened on Thu was, the S&P finished up about 0.30 percent, and it was just above 4380. A lot of that came in the last 30 minutes when we saw a nice upswing for the S&P. The NASDAQ too closed near the highs of the day. Not too long ago NASDAQ was actually floundering there about 10 points lower. Therefore, it was a nice rally going into the close. That Dow Jones was essentially flat from Wednesdays close and just below 34000. NASDAQ Composite was the one leading the way higher, up about a full percent to 13630.

Mid Caps and Small Caps both underperformed. It is worth noting that the Small Cap index is down one percent now. A lot of times, when when people think about Small Caps as a sign of risk on or risk off, its totally fair and if you look over time that’s a reasonable expectation because Small Caps tend to be higher beta higher risk and as a result they usually tend to lead the markets in the bull phase and lag the markets in a down phase. However, one has to remember the sector allocations. The Small Cap Index Is much lower weighting and that’s why when the fang sectors are leading, small caps most likely are struggling on a relative basis on a day like that.

VIX

The VIX keeps going lower and we are at a 12 handle. We haven’t seen anything 12 point for the VIX, in quite some time. VIX below 13 is pretty outrageous, below 15 is incredibly low relative to historical standards. Therefore, we are at all time lows of volatility and that’s not totally true, but certainly long-term lows for volatility. This is a low volatility bull market phase. It is very interested to see if and when that changes. It will change at some point but, as we say many times that day is not Today.

Bonds

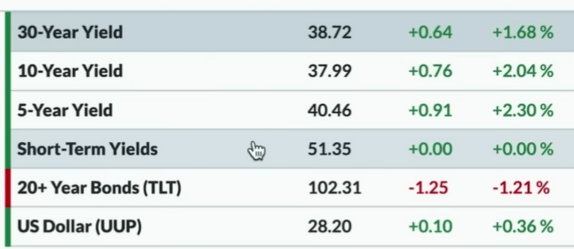

Let’s look at the Interest rate environment. Bonds overall moved lower on Thu therefore, we continued to see a move away from bonds. The TLT which is a long treasury ETF, was down about 1.2 percent, just above 102.30. The yield curve overall moved higher and actually the short-term yields remained fairly steady. Everything else kind of pushed higher to a pretty significant degree. 10-year yields currently are around 3.8 percent, 30-year yields around 387 and the 5-year yield was back above 4 percent to 405. .

Commodity and Crypto

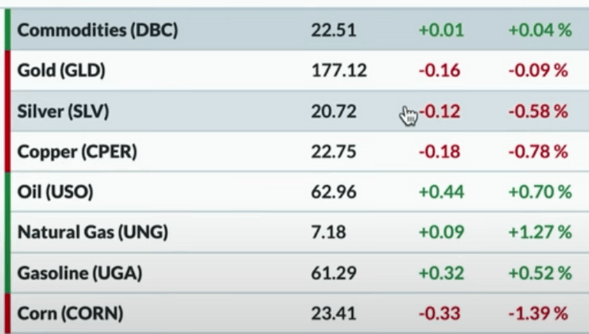

In the Commodity space, the DBC was down about 1.9 percent and it was not a great day for Commodities, particularly for Energy. Crude Oil prices came down quite a bit. The Energy sector has been struggling and Thu as well did not help Energy atall. On Thu, Energy actually rotated back to the downside. Some of those other sectors like Financials struggled quite a bit as well, on Thu. Gold and Silver prices were both in the red. For GLD we see, as that area of the market has been rolling over, basically the trend is broken, support is not holding and it certainly seems to be in a confirmed downtrend.

Cryptocurrency

Cryptocurrency is kind of taking a breather and we call this a digestion day. Basically, a digestion day is after you have a big move. We think of it like the big Thanksgiving meal and then later we need to kind of sit back and let it all settle in and this is what a day like Thu was for something like Ethereum and Bitcoin. These have had really strong runs to the upside and Bitcoin now is above 30000 testing 31000 or nearby. That’s the swing high from back in April. Therefore, most Cryptocurrencies actually had very pretty low percent changes and were kind of digesting the big move that we saw previously. We may argue that the chart of Bitcoin and Ethereum are pretty constructive here, after bouncing off of key support levels.

Sector Performance – Dow Jones and Other Markets

Finally in terms of sectors, as we mentioned, it was the Fang sectors at the top of the list. The XLY, the XLK, the XLC have had a familiar pattern for 2023, but this was not so common in the last week or two, as we had seen the leadership areas of the market take a bit of a pause, However, on Thu, they sort of potentially pushed back higher resuming that uptrend and some of the names that we might show like Netflix were seen breaking out just very very nicely on the downside. Defensive sector Real Estate was at the bottom, down about 1.4 percent and Energy was down 1.3 percent. Then Financials, Utilities,Industrials were all down about 0.72 percent.

Trend and Stock Watch Over Dow Jones S&P and Other Markets

No. 1, we draw our attention to Consumer Discretionary sector, that has emerged as one of the top sectors today along with the other Fang sectors. A Growth leadership that has continued to work. We tried to understand, why the XLY particularly, is doing so well?. Two names make up about 50 percent of this ETF and we also find that Home Depot is another big chunk in this sector. All these three names are pretty much the Lion’s Share and over half of the weight in this ETF.

Just this week, Amazon has made a new high for the year. Tesla also came off a new high for the year, after chopping around a little bit in this week but, overall it is still in a position of strength. What’s interesting is, the equal weighted Consumer Discretionary ETF, which is RSPD (Rehabilitative Services for Physically Disabled ), is still below its February high. Therefore, while the XLY, Amazon, Tesla all breaking out, the equal weighted version is not quite as much, but certainly improving in June and when we talk about the Improvement in breadth conditions, we are talking about how other stocks are starting to participate. We would be keenly looking at something like the RSPD, to see if that continues to move higher. That will tell us, if there’s probably broader strength and not just the mega cap leadership in something like the XLY.

No. 2, we’ve always talked about breadth conditions and the strength that we’ve seen in breadth. We’ve seen signs of breadth becoming a little bit overheated and just in the last week it went above 70 percent. Now, overall that’s a good thing because that tells us that conditions are strong but, every time in the last 12 months, whenever we’ve gone above 70 percent, it has come just right back below. This is similar to a stock becoming overbought using something like RSI and then coming out of that overbought region.

This often lines up with a pullback. We have seen that, previously there’s usually been a decent pullback and a decent drawdown after that overwhelmingly positive breadth condition and now before we come down a little bit, Could it be the end of the world? Maybe or Maybe Not ! but, it tells us that we may be nearing the exhaustion cure and therefore may have already reached the short-term top for something like the S&P and the NASDAQ.